Chartered financial analysts, sometimes called CFAs, work in a wide range of positions and industries. They often assist other financial professionalssuch as certified public accountantsor track and manage a company’s financial objectives. A chartered financial analyst ‘s salary is based in part upon his or her experience, although the nature of the employer, its market value and size, and its sales volume all woth how much a CFA can earn. This series of tests is among the most aith financial certifications to achieve and a minimum of hours of study is recommended for each exam. Those with less than one year of experience earn on the lower end of this spectrum, while those with one to four years of experience fall in the middle of the range on average. A company’s size helps determine how much the company will pays its CFAs. Generally speaking, larger companies pay slightly better than smaller companies, although the differences aren’t extreme. The impact of an employer’s location cannot be understated.

Advanced Lessons

If you look into the brains of students who are pursuing the CFA Program with all their might, we will see one thing common. They have an immense urge to earn big. Before we critically analyze CFA salary data, here are two things we need to consider. Why these two things are important? First, you need to know which job profile you would take after CFA. Second, you need to know which company can employ you in that position. According to the statistics of June , it was found that the top occupation after completion of CFA is of Portfolio Manager. The top 10 employers globally. The companies are ranked according to the number of total candidates and CFA holders. The top ten companies that provide employment to CFAs globally are —. This big picture will help you broaden your vision about CFA certification and what to expect from it.

Beginner Lessons

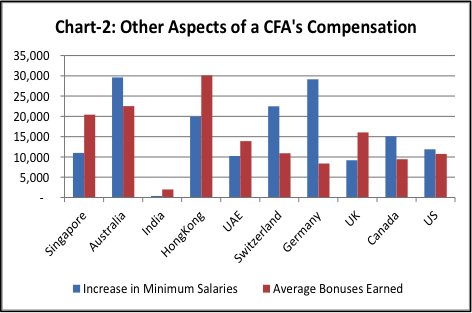

The median total compensation is based on the CFA salary received by all experienced and inexperienced. In light of this study, we will see an overview of total compensation vs. The following chart shows that the bonus and increase in salaries vary as per the country. Even the increase in salary in the USA is not as significant as it should be. Even in the USA, the average bonus earned is not significant.

See Refinements below to see how this return may be affected. This is accomplished by using a stop-loss order. Aaron S. The strategy will all be the same, but the bookmakers and their terms will be different. January 29, at am. However, this option would of course not be risk-free and we really preach going down the route of not gambling. It can earn a lot of money but it depends in Which Country. Marcela says:. December 22, at am. Forex trading can be extremely volatile and an inexperienced trader can lose substantial sums. This means that the potential reward for each trade is 1. How much money does an electrician earn in a year in Australia.

Compensation can vary depending on several factors

Many people like trading foreign currencies on the foreign exchange forex market because it requires the least amount of capital to start day trading. Forex trades 24 hours a day during the week and offers a lot of profit potential due to the leverage provided by forex brokers. Forex trading can be extremely volatile and an inexperienced trader can lose substantial sums.

The following scenario shows the potential, using a risk-controlled forex day trading strategy. Every successful forex day trader manages their risk; it is one of, if not the, most crucial elements of ongoing profitability. That may seem small, but losses do add up, and even a good day-trading strategy will see strings of losses.

Risk is managed using a stop-loss orderwhich will be discussed in the Scenario sections. Your win rate represents the number of trades you win out a given total number of trades. Say you win 55 out of trades, your win rate is 55 percent. While it isn’t required, having a win rate above 50 percent is ideal for most day traders, and 55 percent is acceptable and attainable. If a trader loses 10 pips on losing trades but makes 15 on winning trades, she is making more on the winners than she’s losing on losers.

Therefore, making more on winning trades is also a strategic component for which many forex day traders strive. This is accomplished by using a stop-loss order. For this scenario, a stop-loss order is placed 5 pips away from the trade entry price, and a target is placed 8 pips away.

This means that the potential reward for each trade is 1. Remember, you want winners to be bigger than losers. While trading a forex pair for two hours during an active time of day it’s usually possible to make about five round turn trades round turn includes entry and exit using the above parameters.

If there are 20 trading days in a month, the trader is making trades, on average, in a month. Forex brokers provide leverage up to more in some countries. For this example, assume the trader is using leverage, as usually that is more than enough leverage for forex day traders.

Forex brokers often don’t charge a commission, but rather increase the spread between the bid and askthus making it more difficult to day trade profitably. This estimate can show how much a forex day trader could make in a month by executing trades:. This may seem very high, and it is a very good return. See Refinements below to see how this return may be affected. It won’t always be possible to find five good day trades each day, especially when the market is moving very slowly for extended periods.

Slippage is an inevitable part of trading. It results in a larger loss than expected, even when using a stop-loss order. It’s common in very fast-moving markets. You can adjust the scenario above based on your typical stop loss and target, capital, slippage, win rate, position size, and commission parameters. Most traders shouldn’t expect to make this much; while it sounds simple, in reality, it’s more difficult.

The Balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.

Day Trading Forex. By Cory Mitchell. Article Table of Contents Skip to section Expand. Day Trading Risk Management. Forex Day Trading Strategy.

Hypothetical Scenario. Trading Leverage. Trading Currency Pairs. Larger Than Expected Loss. The Final Word. Continue Reading.

How Much Can You Make Blogging? [Tips for a Small Blog]

But what kind of salary can you earn? Why is there such a big range? Because there is a lot you can do with the charter in jobs with varying degrees of responsibility. Bonuses and years of experience make a difference. The most common titles for executives with the CFA charter are chief investment officer or chief financial officer. CFA Institute Companies hire consultants to bring an independent expert perspective to business valuation, provide economic forecasts and analysis, and identify opportunities to grow shareholder value.

CFA Salary in India

Financial risk managers help identify and assess potential risks that a company faces or could face in the future. Some CFA charterholders work to help their company maintain business relationships with partners and clients to prevent churn. A small percentage of CFA charterholders are financial advisors, helping clients make decisions about investments, how much money can you make with a cfa laws, and insurance product selection. Although earning the CFA designation does not guarantee you a job or a top position at a firm, it can make a difference when an employer is deciding between two otherwise equally qualified candidates. In that situation, the CFA charter could be your competitive advantage. This site requires JavaScript to function properly. Please enable JavaScript before continuing.

Comments

Post a Comment